Found 3 new ways to use consumer shopping data for good

Invalidated the "automated loyalty" idea that would require access to users' transaction data, but found what would motivate people to share this data

Client

Rabobank Innovation department (via Mobiquity)

Year

Jan 2019 - Apr 2019

Role

Service design, research, experimentation, UX/UI design

Impact

We recommended to stop Yunome project, therefore the bank saved a lot of money as it didn't invest in building the solution.

The findings of Yunome inspired 3 new projects. Pin-punten for SMEs who do not have loyalty programs. This spinoff was invalidated.

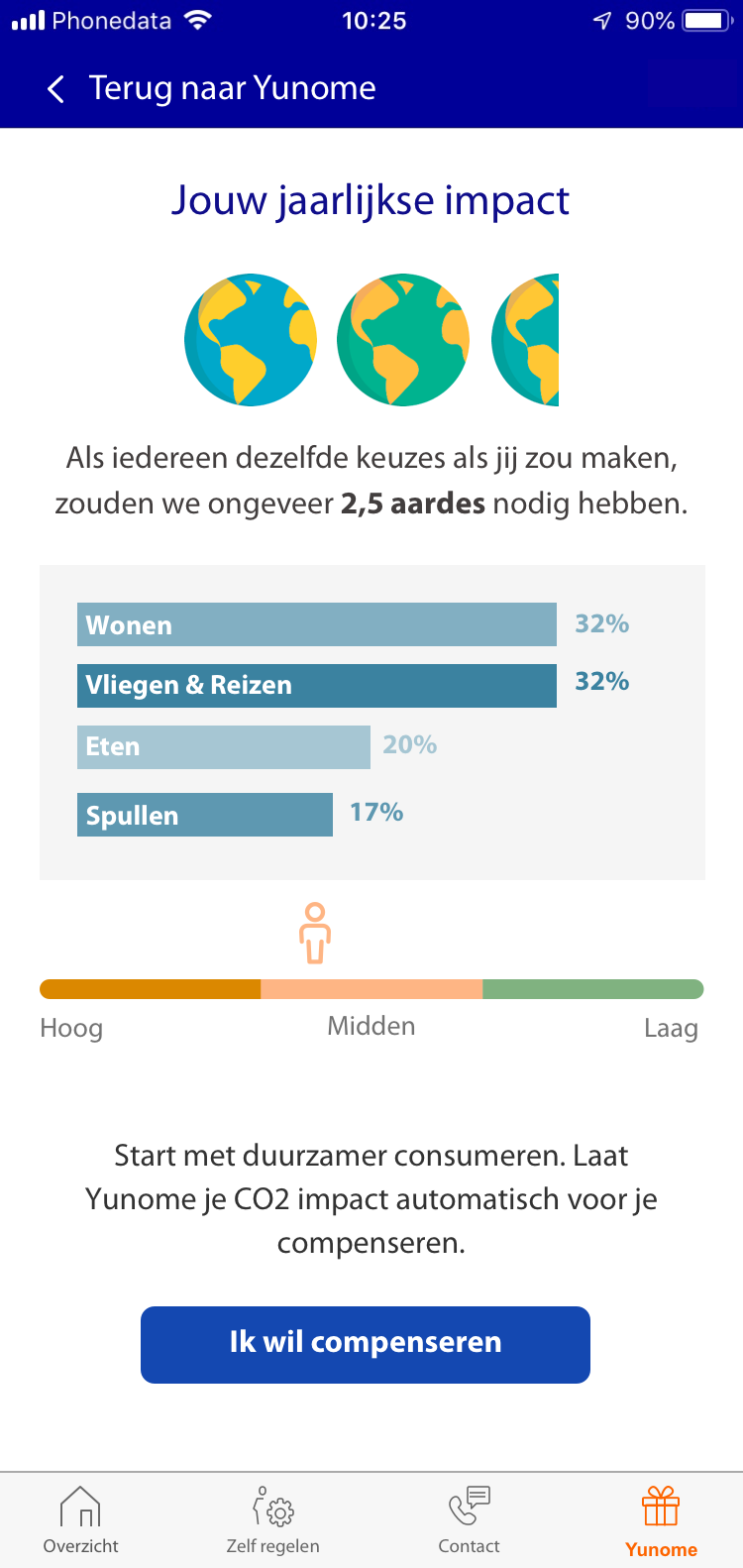

Go.Green.Easy. People who want to find out their carbon footprint based on their spending behaviour could get the data and donate a tree to buy-out their carbon footprint.

Carbon Bank helps companies who cannot reduce their emissions to zero can buy "clean air" from farmers who plant trees. [banken.nl].

Personal impact - I prefer to work on projects that match with my values. I learned how to look for opportunities when it looked like it's impossible to turn this around.

Challenge

Validate the desirability of automated loyalty solution for all brands that wouldn't require users to have physical or virtual loyalty cards.

Outcome

The desirability of users was invalidated as the value to share their transaction data for collecting loyalty points is too low.

Approach

The problems

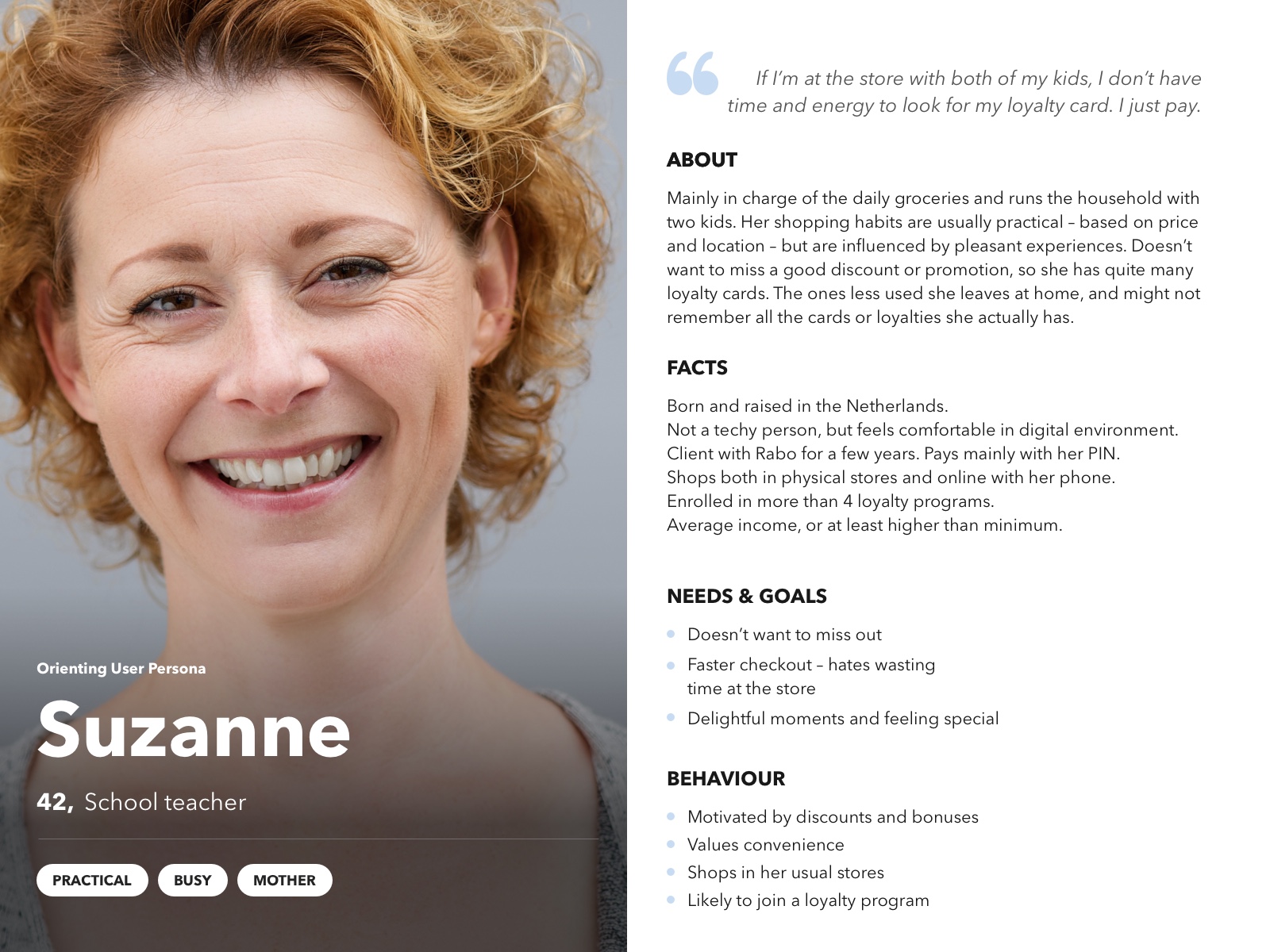

How might we make the participation in loyalty programmes so smooth so that customers like Suzanne would never miss out on loyalty programme rewards?

Right now people have to sign up and carry many digital or physical cards. When they want to use them often they don't know where they are or are too lazy to look for them.

When people don't participate in loyalty programmes, brands miss out on valuable data about their customers.

How might we serve anonymised customers' shopping behaviour data so that it would be useful for brands but remain ethical?

Solution

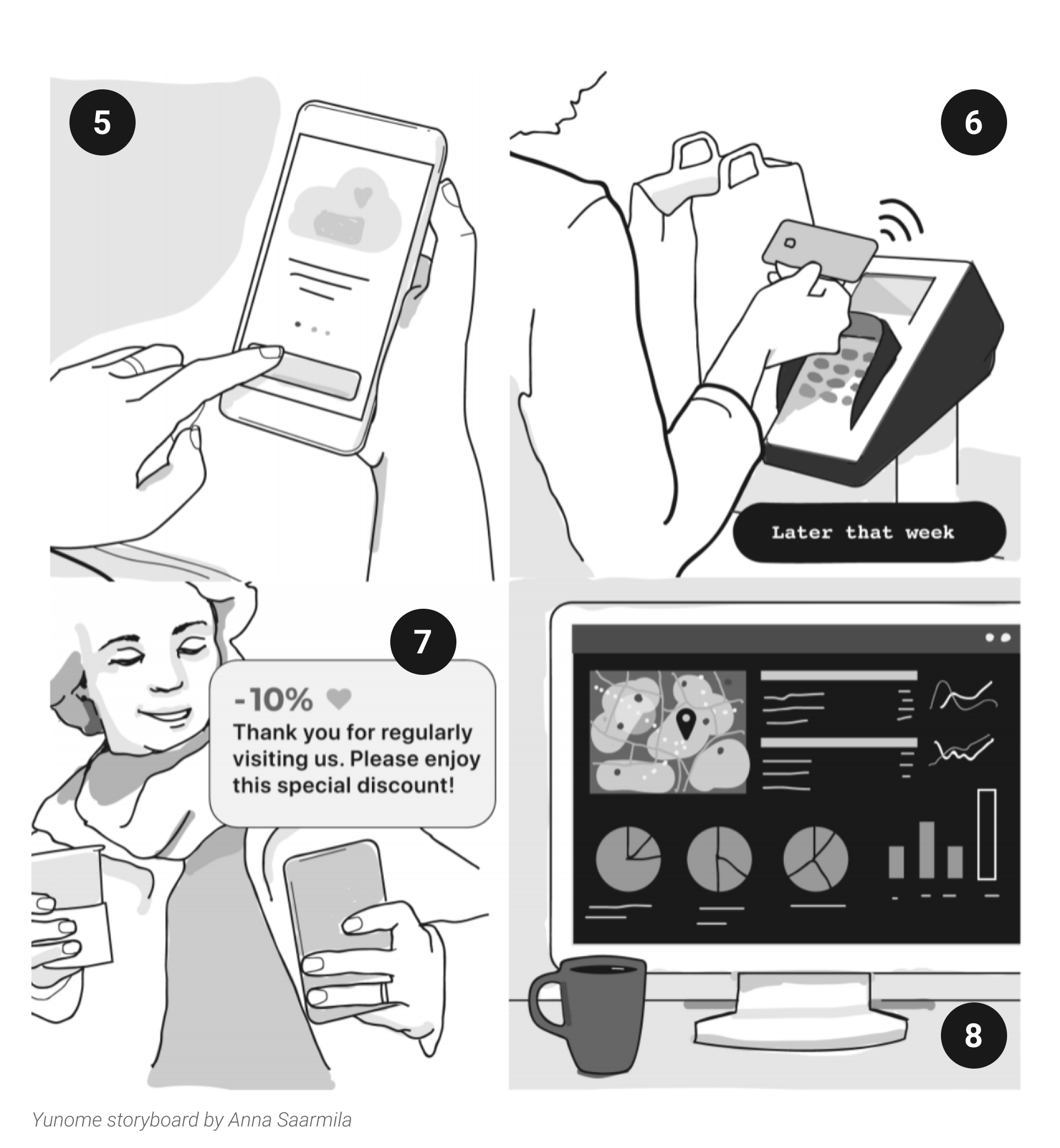

Create a debit card based loyalty solution. When customers shop, the solution has access to their transaction data and so counts loyalty points automatically.

Users do not need to have any digital or physical loyalty cards. They just pay with their registered debit card and receive rewards when they are due.

Brands who have loyalty programmes can receive anonymised customer data about their shopping location, time and see their own market share compared to their competition.

Customer and Supermarket persona

Personas

We have created two personas - Suzanne (the shopper) and Manager of a shop - based on the prior research that was done during the Ideation phase and guerilla interviews in supermarkets.

There are many people who feel bad that they miss out on rewards from their favourite brands that they normally shop.

Experiments and user interviews

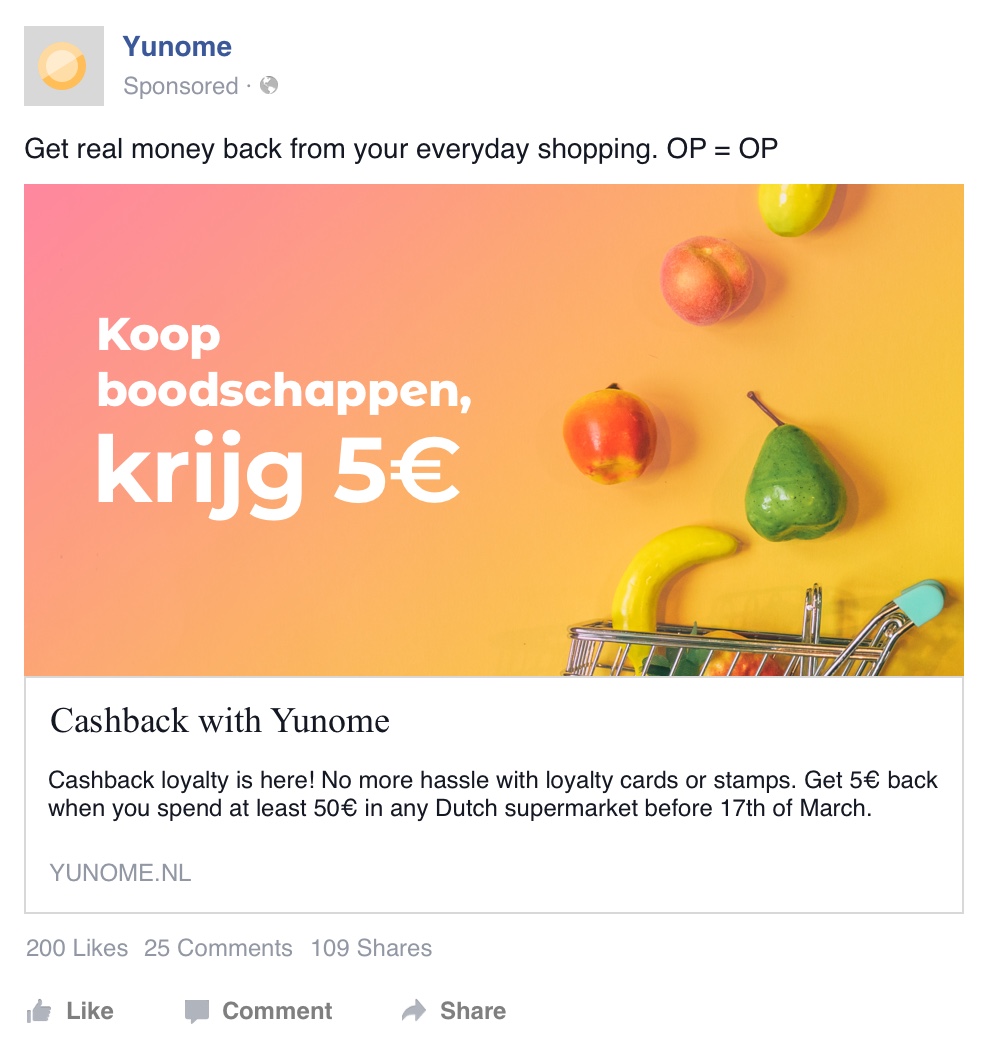

Examples of different value propositions that we have tested using Facebook ads and landing pages where interested people could show their interest by leaving their email address and paying €0,01.

Experiments to validate value proposition for customers

We ran 5 ad-experiments on Facebook to see how many and what kind of people would click in and show their interest by leaving their email address and paying €0,01.

Each experiment lasted 3 days, we targeted women and men of all age groups, who use mobile and have interest in loyalty. The only difference was the value propositions in the ads (e.g. "cashback of €5 from your groceries", "no stamps, no loyalty cards" etc.).

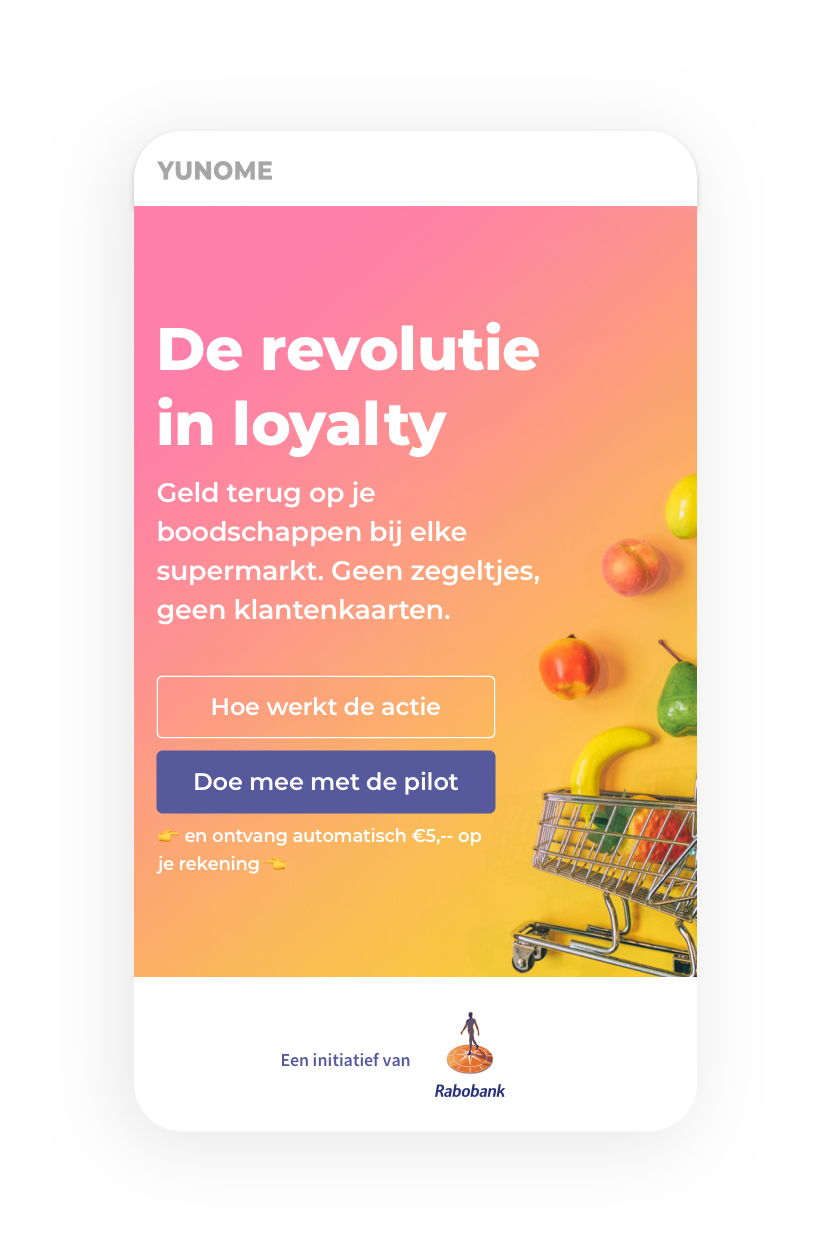

Website and the promotion poster that was used during the experiment that was done in partnership with SPAR in one of their stores in Utrecht, NL

SPAR experiment

The experiment goals were to evaluate if the promotion will attract more people to the store, how excited customers are about the automated loyalty and if they understand how their data is managed. Also we wanted to test how it works technically in real life.

User interviews

We have interviewed 22 people who agreed for an in-depth interview after the experiment. We wanted to understand their shopping behaviour and use of loyalty cards, why they got interested in the promotion, what was their experience.

Most importantly we wanted to know if they understood that they gave access to all of their bank transactions data in order for the solution to work.

During interviews we also gave card sorting exercise for us to understand what benefits would convince them to give access to their transactions data and how much do they think their data is worth

Challenging and promising insights

People didn't realise that in order for the automated loyalty without loyalty cards to work, they need to give access to all of their banking transactions, despite the fact that we explained it on the website.

After explaining how it really works, users advised that if they would have fully understood it they wouldn't have participated in the promotion. This became clear that we cannot move forward with the solution as it is.

Promising trend that we noticed during the interviews was that people are interested in sharing their transaction data if they can later learn something new about their own behaviour, specifically they were interested in their carbon footprint.

Businesses were very interested in buying anonymised customer behaviour data to know their real market share, which brands are valuable partners etc.

Final user testing: cashback vs buy-out of carbon footprint

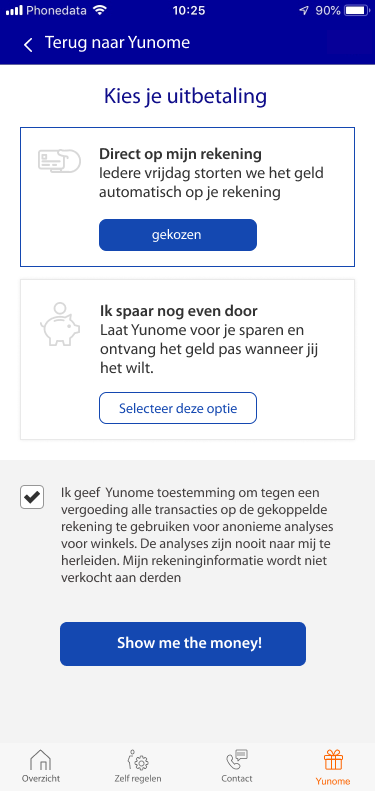

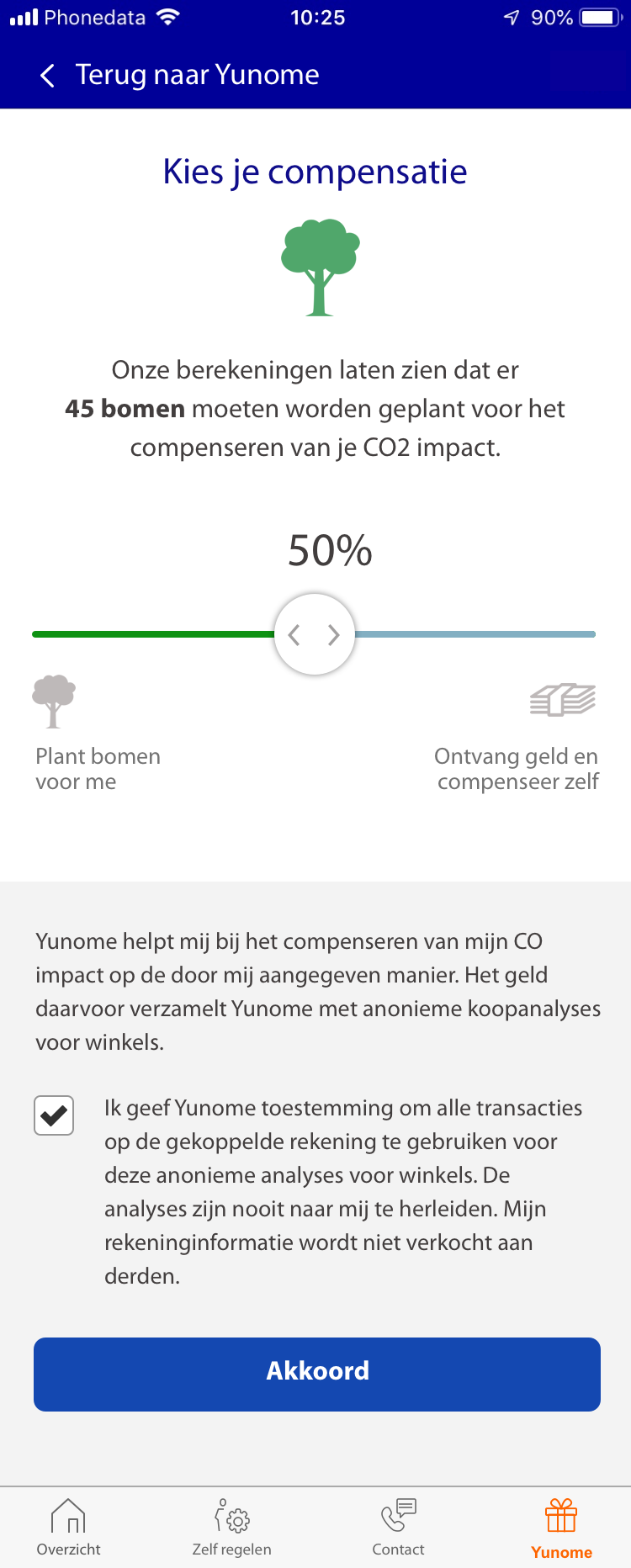

We tested how people perceive the proposition if the product is a part of a mobile banking app. On Yunome tab users can enable participation in loyalty programmes and choose one of the two value propositions.

First option was to receive a cashback or extra discount when shopping at their favourite shops.

Second option was to get an overview of their carbon footprint calculation based on their spending behaviour. People could also choose to buy-out their carbon footprint by planting trees.

Conclusion

We advised to close the project, but it inspired 3 new propositions

The majority of people chose the carbon footprint option. It made sense to them why they need to share their banking transaction data and they were even excited about it.

The initial idea couldn't go forward but it inspired the above mentioned projects: Pin Punten, Go.Green.Easy and Carbon bank.

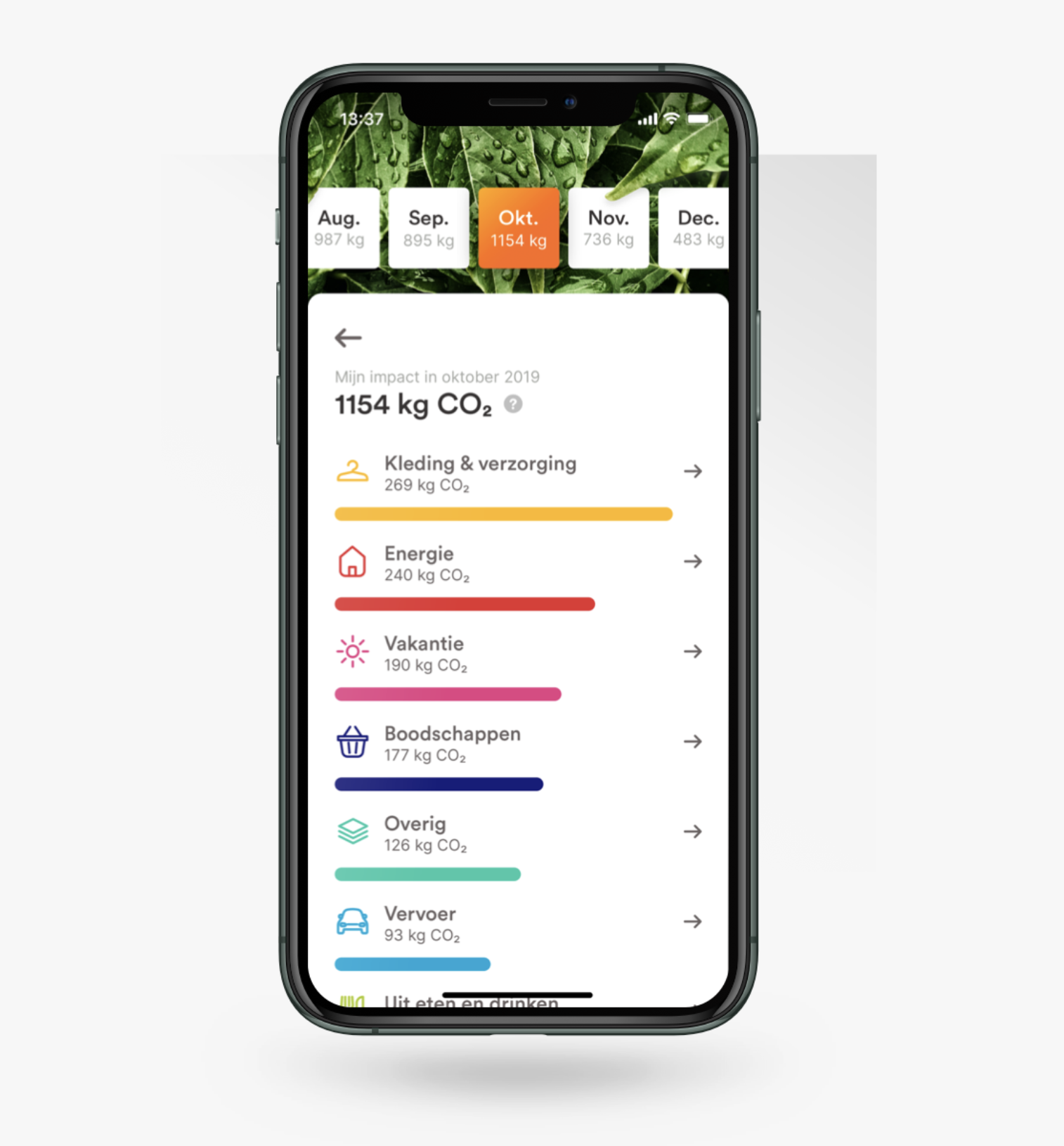

Go.Green.Easy screen that shows users their carbon footprint that is generated by their spending habits (design by my colleague who worked on this project)

Feedback from my PM in Innovation hub

"Vaiva is one of the most talented, cross skilled and effective product designers I have had the pleasure to work with.

I have always been in awe of her majestic ability to orchestrate, drive and follow through multiple threads of work seamlessly, be it user experience strategy, a usability workshop, rapid experimentation techniques and planning, or product design related activities."

Lucia Collará

Lead product manager @Mobiquity at the time

Team operations

Team

2 Designers

1 Product manager

2 Software engineers

1 Security engineer

1 Data scientist

1 Researcher and rapid experimentatiion expert

3 Stakeholders

Methods and practises

Qualitative interviews

Guerilla interviews

Experimentation

Storytelling

Wireframing

Prototyping

Personas

Card sorting

Service design

Tools

Sketch

Invision

Facebook ads engine

Google suite